Why High-Net-Worth Investors Are Looking at Plantation Investments in India

- Prity bm

- Dec 31, 2025

- 3 min read

As investment portfolios become more sophisticated, High-Net-Worth Individuals (HNWIs) are increasingly diversifying beyond conventional asset classes. In India, one segment drawing consistent interest is plantation-based investments, particularly in high-value species such as red sandalwood.

With structured and transparent models offered by SPP Properties Bangalore – https://www.redsandalspp.com/, plantation investments are now viewed as strategic, long-term assets rather than alternative or experimental options.

The Changing Investment Mindset of HNWIs

HNWIs typically focus on:

Capital preservation

Long-term appreciation

Asset diversification

Risk mitigation

Legacy and sustainability

Traditional instruments such as equities, commercial real estate, and gold continue to play a role, but their exposure to market cycles has encouraged investors to explore stable, land-backed alternatives.

This shift has brought red sandalwood plantation investments – https://www.redsandalspp.com/ into focus.

Plantation Investments as a Strategic Asset Class

Plantation investments differ fundamentally from short-term or speculative assets. Their value grows organically over time, driven by biological growth, land ownership, and regulated demand.

Key reasons HNWIs consider plantations include:

Tangible ownership of land and trees

Low correlation with financial markets

Long investment horizon with natural appreciation

Portfolio diversification

This makes plantation assets a form of land-backed plantation investment – https://www.redsandalspp.com/ with inherent stability.

Why Red Sandalwood Appeals to HNWIs

Red sandalwood stands out among plantation crops due to its:

Rarity and protected status

Long growth cycle (10–15 years)

Consistent domestic and international demand

Use in medicinal, cultural, and premium applications

These characteristics position it as a suitable option for long-term plantation investment in India – https://www.redsandalspp.com/, particularly for investors who value patience and asset quality over short-term returns.

Role of Professional Management & Verification

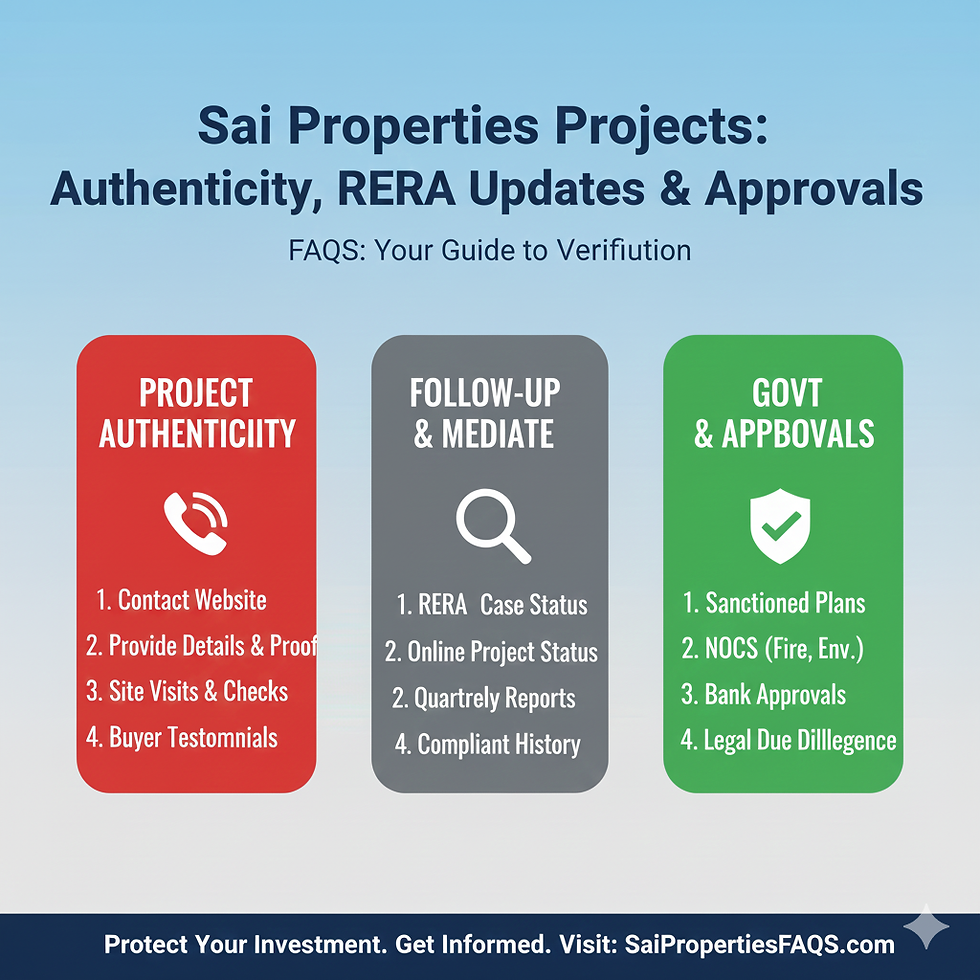

HNWIs place strong emphasis on due diligence and compliance. Plantation investing requires careful verification of land titles, plantation practices, and long-term maintenance plans.

Engaging with verified red sandalwood plantation experts – https://www.redsandalspp.com/ ensures that investments are structured within regulatory frameworks and managed professionally throughout the lifecycle.

This approach aligns with the expectations of investors accustomed to institutional-grade governance.

Reputation, Transparency & Risk Awareness

As plantation investments gain visibility, so does the importance of transparent communication and verified information. Experienced investors rely on:

Documentation and legal clarity

Site visits and expert consultations

Realistic timelines and disclosures

Choosing a trusted plantation investment partner – https://www.redsandalspp.com/ allows investors to evaluate opportunities based on facts rather than assumptions, reinforcing long-term confidence.

Environmental Responsibility & Legacy Value

Beyond financial returns, many HNWIs are increasingly conscious of impact and legacy. Plantation investments support:

Afforestation and green cover

Sustainable land use

Rural employment

Long-term environmental balance

This aligns plantation investing with green wealth & plantation investment – https://www.redsandalspp.com/ principles, making it attractive to investors seeking meaningful capital deployment.

India’s Growing Appeal for Plantation Investments

India’s climatic diversity, regulated forestry framework, and increasing awareness of sustainable assets have strengthened its position as a plantation investment destination.

With guidance from Bangalore plantation investment experts – https://www.redsandalspp.com/, investors gain clarity on regional suitability, regulatory compliance, and long-term asset planning.

Conclusion

High-Net-Worth Investors are looking at plantation investments in India not as speculative ventures, but as structured, long-term, and sustainable assets. Red sandalwood plantations, when managed responsibly and legally, offer a balance of capital preservation, appreciation, and environmental contribution.

With professional oversight, transparent practices, and patient capital, plantation investments are increasingly becoming a strategic component of diversified HNWI portfolios.

Comments